The old adage about there being no such thing as a free lunch may hold true regarding a turkey sandwich on rye bread, but free lunches can happen in the world of higher education. An example of this is the growing number of “last-dollar” scholarships, in which private entities or state/local governments agree to cover students’ remaining tuition and fees after all federal grants have been provided. (Note that it does not cover room and board or living expenses—an important component of the total cost of attendance.)

Consider this hypothetical example of a last-dollar scholarship. A student with a zero expected family contribution (EFC) qualifies for a maximum Pell Grant ($5,730 for the 2014-15 academic year) and a Supplemental Educational Opportunity Grant of $1,500. If she enrolls at a public university with tuition and fees of $9,000 per year, the last-dollar scholarship would then cover the remaining $1,270. But if she goes to a community college with tuition and fees of $5,000 per year, the last-dollar scholarship does not pay a dime.

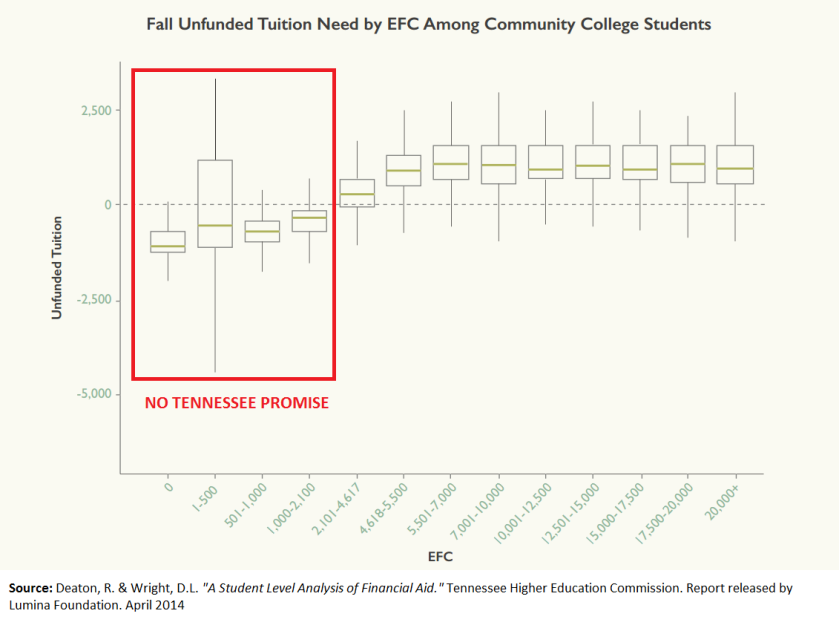

Bryce McKibben of the Association of Community College Trustees (ACCT) analyzed the implications of the new Tennessee Promise scholarship, which promises students free community college tuition and fees if they meet a relatively restrictive set of eligibility criteria. The program is estimated to cost about $34 million per year, suggesting that not many students will benefit. McKibben’s piece mentioned that 35% of Tennessee community college students have a zero EFC, meaning these students will get no additional funds from the program as the maximum Pell Grant of $5,730 far exceeds full-time tuition and fees of under $4,000 per year. Indeed, an analysis by the Tennessee Higher Education Commission showed that the median student with an EFC of under $2,100 would not see a dime from the Tennessee Promise:

This doesn’t mean that last-dollar scholarships don’t have value. They do benefit community college students who barely miss qualifying for the federal Pell Grant, as well as students attending four-year institutions (such as under Indiana’s 21st Century Scholarship program). Another important benefit of last-dollar scholarship programs is informational. Students may be induced to attend college simply by having better knowledge of what college costs, even if they do not receive any additional money. The literature on college promise programs, as I summarized in this paper, suggests that informational campaigns can increase college enrollment rates by several percentage points.

Last-dollar scholarships are politically attractive due to their clear message about college costs (even if they’re excluding any housing or living expenses) and relatively low cost. If the goal is to help the neediest students afford college, however, states may want to consider adding stipends to students whose tuition is already covered by funds from other sources.

3 thoughts on “The Political Attractiveness of “Last-Dollar” Scholarships”

Comments are closed.